Chapter 7 and Chapter 13 bankruptcy are only two of the four bankruptcy options that one can choose from in the United States. They are options when an entity is no longer able to pay for their liabilities. Here are the differences between chapter 7 and chapter 13 bankruptcy.

Chapter 7 bankruptcy, also called liquidation bankruptcy, is when an entity liquidates their non-exempt assets and uses the proceeds to pay to their creditors. It’s basically selling away whatever available assets you have in order to settle liabilities.

When entities make too much money to qualify for filing Chapter 7 bankruptcy, they may opt for Chapter 13 bankruptcy. Here, entities are made to create debt repayment plans. The difference is that because there is an arrangement to pay off the debts efficiently, there is the advantage of retaining their property, including the non-exempt ones.

Chapter 7 |

Chapter 13 |

|

|---|---|---|

| Definition | A form of bankruptcy where the debtor liquidates their non-exempt/personal assets to pay for their liabilities | A form of bankruptcy where the debtor creates a debt repayment plan to settle liabilities |

| Also known as | Liquidation bankruptcy | Wage earner’s plan |

| What happens here? | Personal/non-exempt assets are liquidated (sold) and the proceeds are used to pay creditors | When an entity earns too much to qualify for chapter 7 bankruptcy, they are made to create a debt repayment plan based on their income, liabilities, and other factors |

| Does it involve a trustee? | Yes | Yes |

| What is the role of the trustee? | The trustee makes sure that the assets are secured and liquidated and that the proceeds are paid properly to the creditors | The trustee reviews the plan for legal compliance, receives the payments, and distributes them to the creditors based on the manner required by law |

| Does it involve liquidation of assets? | Yes, to the extent of non-exempt assets | No |

| Is there debt forgiveness? | Yes; this may occur when the proceeds from liquidation cannot cover all loans | Unsecured debts may be discharged or partially paid, depending on the nature of the liability |

| Who can file for this? | Individuals, married couples, business organizations | Individuals in the U.S. with regular income who are not stockbrokers/commodity brokers and are in the range of the stated amounts of unsecured and secured debts |

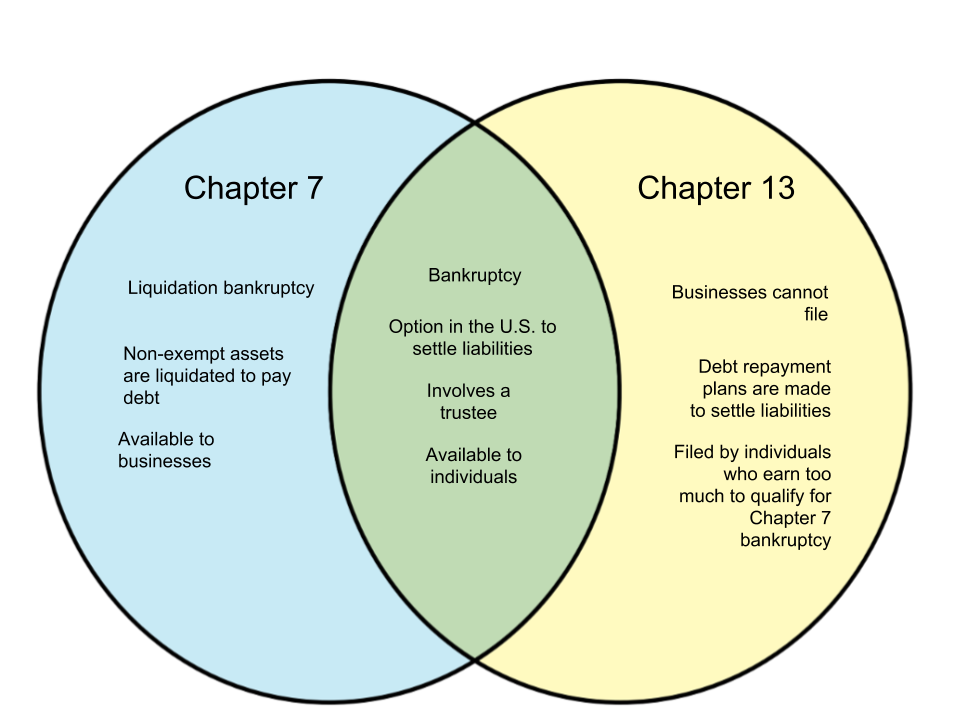

Venn Diagram

Thank you for sharing the differences between chapter 7 and chapter 13 bankruptcy. It’s interesting that companies cannot file chapter 13. You did a fantastic job comparing both with the diagram.