There are different terms and actions taken in the investment world and this includes the limit order and stop order. These two terms may seem similar at a glance but they can have a significant distinction in trading. In this article, we will examine the differences between a limit order and stop order.

Limit Order

A limit order is also called a stop limit order. It is a type of trading action that combines two kinds of orders. In this initiative, an order is made to buy or sell a stock at a designated price or at better value to the investor. First, investors assign a stop price. Then they assign a limit order value. If the action is buying, the buy limit order is set to be executed at the limit price set or at a lower value. On the other hand, a sell limit order will be executed once it arrives at the limit price or higher. Limit orders do not guarantee execution.

Stop Order

A stop order is a more simple action that involves setting a stop price to limit a loss or to protect profits on certain stocks under their ownership. It is also called a stop-loss order. When a stop price is reached, a market order is immediately executed. A buy stop is set above the current market price while a sell stop is below the current market price.

Limit Order |

Stop Order |

|

|---|---|---|

| Action taken | To execute a trade at a value equal to or better than a designated price Buy – execute order once the value reaches the limit price or a lower value Sell – execute order once the value reaches the limit price or a higher value |

To execute a trade when a value moves beyond the designated target

Buy – execute order once price climbs over set stop value; stop price designated above the current market price Sell – execute order once price climbs below set stop ; value; stop price designated below current market price |

| Purpose | To lock in prices so that investors can buy or sell at a particular price that is better for them | To limit losses or protect profits on owned stocks |

| Risks | Risk of non-execution; higher stockbroker commissions | Short term fluctuations wherein trade price is worse than the stop price |

| Also called | Stop-limit order | Stop-loss order |

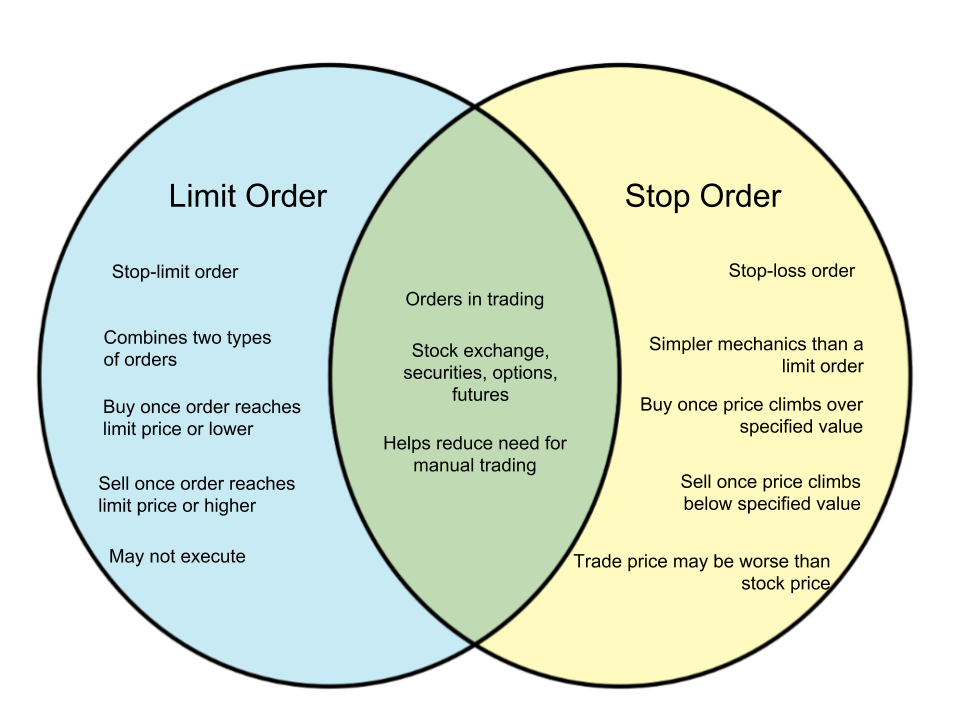

Venn Diagram